New Jersey EV Proposal Addresses Major Charging Obstacles

Friday, May 29, 2020 at 3:39PM

Friday, May 29, 2020 at 3:39PM  Grant Gerke

Grant Gerke

By John Gartner, Vehicle Electrification and Mobility Consultant and Researcher.

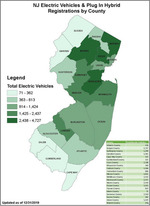

[Click image to Enlarge] Gov. Murphy's goal of 330,000 electric vehicles by 2025 is going to need a strong utility plan and soon as the end of 2019 revealed only 29,601 EV and PHEVs on the road in the garden state. (Source: Drive Green NJ)Utilities are known to focus on reliability of service and for not wanting to be first when it comes to implementing a new technology or policy. The New Jersey Board of Public Utilities (BPU) has conscientiously avoided being on the bleeding edge of electric vehicle (EV) policymaking. The BPU’s recently released straw proposal for supporting EVs shows that they have been studying other states' experiences, and it astutely recognizes and addresses many of the significant challenges faced in operating and integrating EV charging stations.

[Click image to Enlarge] Gov. Murphy's goal of 330,000 electric vehicles by 2025 is going to need a strong utility plan and soon as the end of 2019 revealed only 29,601 EV and PHEVs on the road in the garden state. (Source: Drive Green NJ)Utilities are known to focus on reliability of service and for not wanting to be first when it comes to implementing a new technology or policy. The New Jersey Board of Public Utilities (BPU) has conscientiously avoided being on the bleeding edge of electric vehicle (EV) policymaking. The BPU’s recently released straw proposal for supporting EVs shows that they have been studying other states' experiences, and it astutely recognizes and addresses many of the significant challenges faced in operating and integrating EV charging stations.

The proposal appropriately focuses on three important topics: the financing of "make-ready" charging locations, EV charging equipment ownership, and tariff structures for demand charges. While omitting one that will be crucial over time, vehicle grid integration (VGI) services.

The proposal seeks to delineate the requirements for utilities and charging service providers. Under the proposal, utilities in New Jersey have the responsibility to fund via ratepayer expense and prepare "make-ready" locations while mostly excluding owning or operating the charging equipment itself. Preparing a location to host EV charging, called Charger Ready by BPU, entails performing necessary capacity upgrades and installing essential equipment, such as wiring, needed to provide sufficient power for a charging station to serve EVs. California and other states already have set a precedent for utilities investing in EV make-ready programs.

The proposal seeks to minimize the investment made by ratepayers by being equitable to all customers, including those who do or do not own EVs. This is a wise strategy that may stave off some of the challenges that consumers’ unions often present during the rule-making process. From the utility commissions’s perspective, EVs are just another electricity customer, and funding distribution investments to serve them is within utilities' bounds.

Also, New Jersey is undertaking an "EV Mapping Effort" to identify the gaps in infrastructure. Making this type of analysis publicly available complements private sector research and should reduce inefficiencies in locating chargers.

Gov. Murphy's goal of 330,000 electric vehicles by 2025 is going to need a strong utility plan and soon as the end of 2019 revealed only 29,601 EV and PHEVs on the road in the garden state. (Source: Drive Green NJ)

On the topic of EV charging ownership, the BPU straw proposal is consistent with conclusions in other states that focus on the private sector, while limiting utility participation. Private sector investment by EV charging companies is widespread and mostly fills the need for infrastructure. However, the BPU's proposal mostly restricts utilities to "last resort" ownership at locations where "socio-economic and demographic challenges may result in"… [areas where] "…the market is not sufficiently mature to build EVSE on a purely merchant basis."

Related Content | Xcel Energ May Have a Transformational EV Charging Station Solution for Multi-Unit Dwellings

This narrow view of utility charging ownership does serve an important segment of the ratepayer population, who may not live in housing types that offer access to overnight charging and therefore have a greater need for public charging. Many other state utility commissions (e.g. In Oregon) have approved utilities ownership of a backbone of charging infrastructure anywhere in the service territory where there is a gap in investment. A broader role for utilities provides them with an opportunity to create positive revenue streams for charging and offering greater access to electricity service for all EV drivers, and increased electricity sales to EVs can benefit all ratepayers by preventing or delaying tariff increases.

However, limiting ownership of charging infrastructure to only the most economically challenging locations is more likely to result in ratepayers not getting a return. Utilities have primarily focused on DC fast charging, while the private sector can expand market presence in both Level 2 and DC fast charging as EV sales continue to climb and new infrastructure is needed. It is indeed a challenge to appropriately size the "backbone" charging infrastructure, and utilities have generally been conservative in what are mostly pilot programs.

How to make DC fast charging affordable to drivers while protecting utility operating costs via demand charges has been a hotly debated topic in many states. BPU smartly recommends:

To aid in adoption of this new technology, this Straw directs each {utility} to either waive demand charges associated with EV charging or develop a rebate methodology that ensures that the effective $/kW-hour rate (i.e., the demand charge averaged over the number of kW-hours used in a given month added to the standard $/kW-hour rate) remains below a specified “set point."

Potential site hosts and charging network operators have declined to install DC fast chargers in locations where demand charges are viewed as so onerous as to make operation not economically feasible. By capping or waving demand charges in New Jersey, private sector investment in DC fast charging would likely blossom and spread to a wider variety of locations.

Somewhat surprisingly, the terms "integration" and "vehicle-to-grid" are missing from the straw proposal. While ancillary services and demand response programs that enroll personally-owned EVs are in their infancy, vehicle-to-grid services have great promise, especially for fleets and commercial charging stations, such as at workplace locations.

According to Accenture, the EV grid services market will be $100 billion in the U.S. in 2040. This revenue is likely to be divided between the utilities, charging operators, site hosts and the EV owners themselves. While determining appropriate revenue shares is complicated and less of an immediate need, the BPU plan would be more comprehensive if it recognized that utilities and charging networks have other substantial economic benefits beyond the selling of electrons and charging services.

Also, in many states such as Hawaii and California, transportation electrification is an integral part of utilities' goals for reducing emissions and load balancing as the percentage of renewable generation sources increases. As energy efficiency and residential solar have slightly eroded electricity demand as of 2020, EVs can offset much of this loss as a reliable, manageable and rapidly growing load.

New Jersey is clearly standing on the shoulders of those who have tackled EV charging regulatory policy before in drafting its initial proposal. It will be interesting to see how stakeholders react during the upcoming meetings— June 3&—and revision process."

EV Parade Reads | Maryland Scales Back EV Charger Program nearly 80%

Reader Comments